In the UK's Autumn Budget 2024, the government announced an annual ISA allowance freeze, which affects all adult and Junior ISAs for the next five years. This article will tell you everything you need to know about Junior ISA allowances as the new tax year begins.

What Is A Junior ISA?

A Junior ISA is a tax-free savings or investment account for children under the age of 18. A parent or legal guardian can open and deposit money into a Junior ISA on behalf of their child. Other family members and friends can contribute by depositing money into the account, helping to build savings for the child's future.

The money in a Junior ISA remains tax-free, no matter how much it grows. For the 2025/26 tax year, the annual contribution limit is £9,000 per child. Additionally, deposits are protected by the Financial Services Compensation Scheme (FSCS) up to £85,000 per authorised financial institution, offering added security for your child's savings.

There are two types of Junior ISAs available for children in the UK:

- Junior Cash ISAs: A Junior Cash ISA is similar to having a savings account with a bank or building society. But unlike a traditional savings account, the savings are completely tax-free. That means no income tax or dividend tax is charged on the money saved or the interest earned. When the child reaches 18, they can decide whether to withdraw their savings or let the account mature into an adult ISA, continuing to enjoy the tax-free benefits.

- Junior Stocks and Shares ISAs: A Junior Stocks and Shares ISA allows you to invest the money you plan to save for your child into funds, shares, and bonds. Any profits you earn due to an increase in the value of the investments are free from capital gains tax when the money is withdrawn or transferred by the child. However, investments are riskier than cash, as the value can go up and down.

What Should I Know About Junior ISA Allowances?

The annual allowance for a Junior ISA is £9,000 for the 2025/26 tax year. This has remained the same since the 2020/21 tax year. The annual allowance runs from 6th April to 5th April each tax year and cannot be carried over, so any unused amount is lost at the end of the tax year.

If more than £9,000 is deposited into a Junior ISA in one tax year, the excess money is held in a savings account in trust for the child and can't be returned to the donor.

On 30th October 2024, the Chancellor of the Exchequer, Rachel Reeves, announced the Autumn Budget, which highlighted that all adult and Junior ISA annual allowances were frozen until at least the 5th April 2030. This announcement came even though annual ISA allowances are meant to increase in line with inflation.

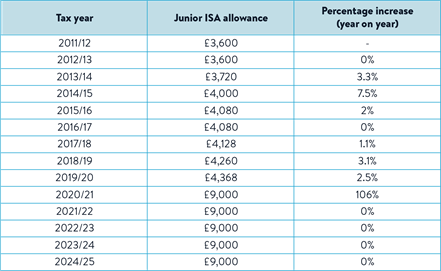

When the Junior ISA launched, the annual allowance was £3,600 for the 2011/12 and the 2012/13 tax year. It then rose 3.3% to £3,720 the following year and a further 7.5% the year after to £4,000. It gradually increased until it reached £4,368 in the 2019/20 tax year before rising by 106% to the current allowance of £9,000.

(Image Source: Wealthify)

What Else Should I Know About Junior ISAs?

It's important to understand that the money in a Junior ISA belongs to the child, and they have the power to decide what happens with the savings when they turn 18. The account will automatically be rolled over into an adult ISA of the same type. However, the child also has the choice to withdraw the money and spend it as they like. For example, on a holiday, driving lessons, further education, or their first home.

A child born between 2002 and 2011 might have a Child Trust Fund (CTF) in their name. CTFs can easily be transferred into a Junior ISA, but if they are not, the child can still access the money or choose to transfer it into a Cash ISA when they turn 18.

Wrapping Up

If you have opened a Junior ISA on behalf of a child or you are planning to do it in the near future, it's essential to know all about the annual ISA allowances. This ensures all the money deposited, invested, and earned in the ISA remains free of income tax, dividend tax, and capital gains tax.